Startups, venture capital firms seek tax benefits | India News

MUMBAI: Startups and venture capital (VC) firms are seeking an easier tax regime and measures to boost availability of domestic capital in the upcoming Budget.

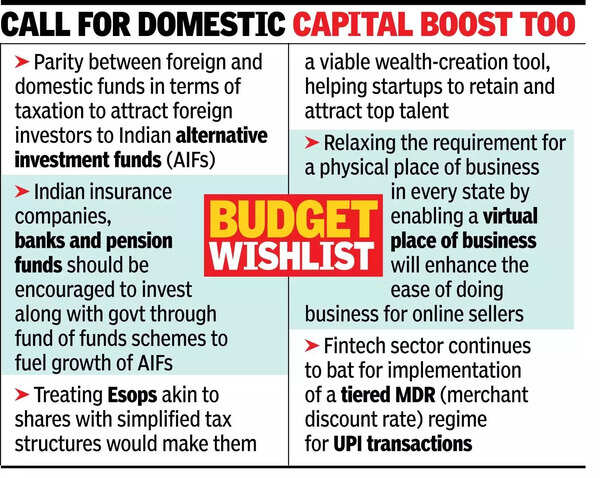

Parity between foreign and domestic funds in terms of taxation is required to attract foreign investors to Indian alternative investment funds (AIFs), said Siddarth Pai, founding partner at 3one4 Capital and co-chair of regulatory affairs committee at Indian Venture and Alternate Capital Association (IVCA).

“If foreign investors see foreign funds enjoying better tax treatment in India, they will prefer these foreign vehicles instead of Indian AIFs. This parity will also attract investors and fund managers to GIFT IFSC,” said Pai.

Insurance companies, banks and pension funds should be encouraged to invest along with govt through fund of funds schemes to fuel growth of AIFs, said Padmaja Ruparel, co-founder at Indian Angel Network (IAN). This will enable expansion of domestic capital for startups, Ruparel said. AIFs are pooled investment vehicles for investing in assets like startups. Current norms do not allow insurance companies and pension funds to invest in startups directly; they can only do so via fund of funds which are allowed to invest in AIFs.

India requires a sovereign-backed fund of funds anchored by SIDBI which allows contributions from banks, insurance companies and global sovereign wealth funds, said Anirudh A Damani, managing partner at ArthaVenture Fund. “With SIDBI as the anchor, this approach will create a much-needed pool of patient capital catering to startups across stages,” said Damani, adding that the government should also expand the definition of startups to allow more businesses to get backing. The current DPIIT startup classification limits eligibility to companies up to 10 years of age or with a turnover of less than Rs 100 crore.

Startups are seeking some relaxation in Esop (employee stock ownership plan) tax regime. Treating Esops akin to shares with simplified tax structures would make them a viable wealth-creation tool, helping startups to retain and attract top talent, said Mayank Kumar, co-founder at upGrad. The fintech sector continues to bat for implementation of a tiered merchant discount rate regime for UPI transactions.