S&P 500 Hits Record High Amid Strong Earnings and Easing Inflation Concerns

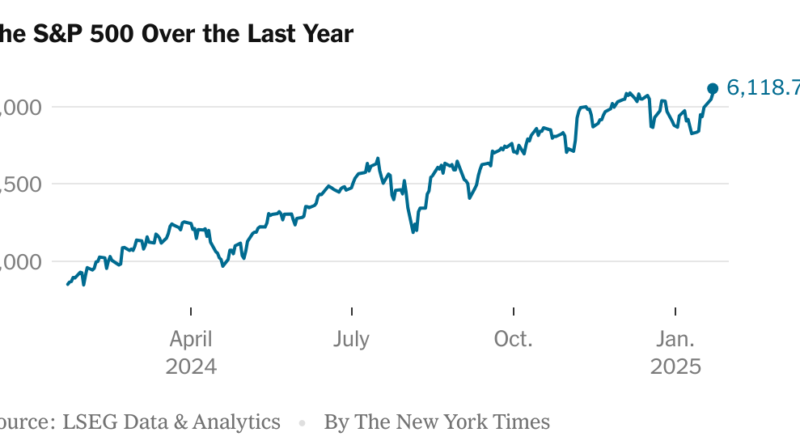

The S&P 500 clambered back to a record high on Thursday, inching above a peak reached in early December, building on gains after President Trump reiterated his commitment to bring down oil prices — a major component of inflation.

The S&P 500 rose just 0.5 percent on Thursday, but the gain added to a winning streak that began more than a week ago with data that showed inflation slowing in December by more than economists had expected. With Thursday’s rise the index is up 4 percent in the first three weeks of the year.

The recent rally arrived after the market had languished for weeks, as investors worried about the inflationary impact of policies promised by Mr. Trump — in particular, new tariffs and a mass deportation program that could push up consumer prices and wages.

Wall Street was concerned that the resulting inflation would prompt the Federal Reserve to leave interest rates higher than previously expected, as it sought to keep consumer price gains under control. Higher interest rates raise the cost of borrowing for consumers and companies and typically weigh on valuations in the equity market.

But the release of new inflation data in recent weeks has eased those concerns, with investors receiving another boost on Thursday, when Mr. Trump, at the World Economic Forum in Davos, Switzerland, promised to “bring down the cost of oil.”

West Texas Intermediate crude oil fell over 1 percent on Thursday to $74.62 per barrel.

In the bond market, the two-year Treasury yield — which is sensitive to changes in interest rate expectations, which are in turn dependent on the path of inflation — nudged lower on Thursday.

While the 10-year Treasury yield — a crucial market interest rate that underpins corporate and consumer borrowing — inched higher on Thursday, it has also moved markedly lower over the past week.

“Yields have been moving lower after that inflation data,” said Lauren Goodwin, an economist at New York Life Investments. “That’s foundational to the equity market moves we have had this week.”

Some investors have also been pleased to see the Trump administration taking its time over tariffs and his threat of mass deportations. Mr. Trump has pledged to impose a 25 percent tariff on imports from Canada and Mexico, and a 10 percent tariff on imports from China — but not until February. Before he took office, the president said he was considering tariffs of up to 60 percent on imports from China.

“The worst fears have not been realized and that has helped the market move higher,” said David Kelly, chief global strategist at J.P. Morgan Asset Management.

Rising stock valuations have also been supported by a string of positive corporate earnings reports. Netflix soared almost 10 percent on Wednesday after reporting the strongest subscriber growth in its history for the final quarter of last year. General Electric rose roughly 6.5 percent Thursday after beating analysts’ profit expectations.

For companies in the S&P 500, earnings are on course to grow by more than 12 percent for the fourth quarter compared with the same period in 2023, according to data from FactSet. That would make it the best quarter for company profits since the end of 2021.

Some signs of caution persist, however: Inflows into funds that buy U.S. stocks have slowed and a measure of investor ownership of stocks from Deutsche Bank has fallen to its lowest level in two months.

The S&P 500 rose by more than 20 percent in 2023 and 2024, leading to warnings that the rally may have gone too far, especially the growth of big technology companies that now dominate the market, leaving many investors dependent on their performance.

Jamie Dimon, chief executive of JPMorgan Chase, said in an interview with CNBC on Wednesday that asset prices had already become elevated. “You need fairly good outcomes to justify those prices,” he said.

That makes parsing out bluster from intended action vital when it comes to the new administration, said Ms. Goodwin.

“What changes in our day to day is the risk or reality that the market is reacting to something on Truth Social,” she said. “It’s not a good thing or a bad thing, it’s a new thing.”