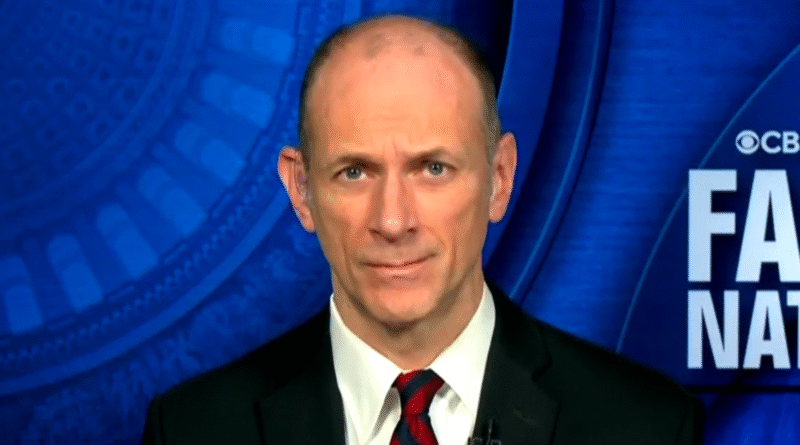

Transcript: Chicago Fed president Austan Goolsbee on “Face the Nation with Margaret Brennan,” April 20, 2025

The following is the transcript of an interview with Austan Goolsbee, Chicago Federal Reserve Bank president, that aired on “Face the Nation with Margaret Brennan” on April 20, 2025.

WEIJIA JIANG: We turn now to the economy and the president of the Chicago Federal Reserve Bank, Austan Goolsbee, he joins us this morning from Chicago. Austan, it’s great to see you this morning.

AUSTAN GOOLSBEE: Yeah. Thank you for having me, Weijia.

WEIJIA JIANG: I want to talk about President Trump’s tariffs plan, because last week, Federal Reserve Chairman Jerome Powell said tariff increases were higher than expected, and the economic effects will be too, including higher inflation and slower growth. Do you agree with that assessment?

AUSTAN GOOLSBEE: Well, look, I’m out here. The Chicago Fed district is kind of the heart of the Midwest, Iowa, Illinois, Indiana, Wisconsin, Michigan. Folks, when I’m out talking to them, business people and civic leaders have been saying for months that they had anxiety that if the tariffs were going to be as big as- as what- what they were saying they might be in February, March, that that would have a pretty significant impact on their operations. The tariff announcement, April 2, was definitely bigger than- than what- what they had been expressing, but there’s just a lot of question marks. We don’t know 90 days from now, when, when they’ve revisited the tariffs, we just don’t know how big they’re going to be.

WEIJIA JIANG: Yeah, and the administration says they have a lot of deals in the works, so we have to wait to see what those look like. Trump’s former top economic adviser Gary Cohn, was on CNBC talking about what he is hearing from business executives about how they are impacting consumers right now. I want to play that- some of that for you.

(BEGIN SOUND ON TAPE)

GARY COHN: What everyone’s worried about is June, July and August. Are we just pulling all this demand forward from the summer? Because people that were going to buy stuff naturally through the next six months are saying, Look, I’m going to save the tariff. I’m going to buy it now.

(END SOUND ON TAPE)

WEIJIA JIANG: So, he’s talking about people trying to get ahead of the tariffs in case no deals are reached in case those high numbers do get put into effect. So I wonder if you’re hearing the same from your contacts in Chicago that people are trying to rush out there to buy, and how does that impact your outlook for the economy?

AUSTAN GOOLSBEE: Yeah, that kind of preemptive purchasing is probably even more pronounced on the business side, where in anticipation, a lot of the imports that the tariffs would apply to, especially in the auto sector, are things that are parts, components, supplies that go into the manufacturing of other products. So we heard a lot about preemptive building up of inventories that could last 60 days, 90 days, if there were going to be more uncertainty. That raises the possibility that that Gary Cohn raised there, that activity might look artificially high in the initial and then by the summer, might fall off, because people had bought it all and brought it forward. I’m still hopeful, and the people that I talked to out in the Midwest are still hopeful that on the back end of this, it would be more like what Secretary Besent said, that this could be a spark to lead to a new he called it golden age of global trade. If we can get through this, it’s important to remember the hard data coming into April was pretty good, the unemployment rate around steady, full employment, inflation coming down. It’s just a desire of people expressing they don’t want to go back to kind of 21 and 22 at a time when inflation was- was really raging out of control.

WEIJIA JIANG: Got it. I do want to go back to Jay Powell’s remarks about the impact of tariffs, or potential impact, because they prompted President Trump to lash out by declaring “Powell’s termination cannot come fast enough.” Here’s what the President said when reporters pressed if he has the power to remove Powell.

(BEGIN SOUND ON TAPE)

DONALD TRUMP: I’m not happy with him. I let him know it, and if I want him out, he’ll be out of there real fast, believe me.

(END SOUND ON TAPE)

WEIJIA JIANG: Now, Austan, I know the Fed does not wade into politics, and I’m not going to ask you to do that, but I wonder if statements like this undermine or complicate your job as an apolitical institution?

AUSTAN GOOLSBEE: Look, I’m glad you didn’t ask me for legal advice, because I have an econ PhD. Don’t ever ask legal advice from somebody like me. I would say, monetary independence- before I was ever at the Fed, I was a research economist at the University of Chicago. There’s virtual unanimity among economists that monetary independence from political interference, that the Fed or any central bank be able to do the job that it needs to do, is really important. And they came to that not as a theory, but just by looking around the world at places where they don’t have monetary independence. And the fact is, the inflation rate is higher, growth is slower, the job market is worse. So we really- I strongly hope that we do not move ourselves into an environment where monetary independence is questioned. Because that- that would undermine the credibility of the Fed.

WEIJIA JIANG: All right, Austan, thank you so much for your time, and Happy Easter to you.

AUSTAN GOOLSBEE: Yeah, happy Easter. Great to see you, Weijia.

WEIJIA JIANG: We’ll be right back.